Equities markets and the crypto market continue to struggle as Europe and the United States enact increasingly drastic measures to ward off the spread of the Coronavirus. Among the general public and investors, there is a feeling that world governments have drug their feet in responding to what is clearly an urgent crisis, thus major markets continue to tumble.

The Dow opened sharply down, triggering the circuit breaker which halted trading for 15 minutes. Despite the intervention and a live statement from President Trump, the Dow is down 7% and the S&P 500 has dropped by 6%.

Fed vows to inject $1.5 trillion

By the afternoon hours, the U.S. Federal Reserve revealed a plan to beef up its funding operation by at least $500 billion and there are also plans to expand the classes of securities that will be purchased. This announcement helped major markets recover roughly 50% of their daily losses but was short-lived as the selloff continued less than 30 minutes later.

Surprisingly, it took less than two weeks for a historic 11-year bull market to shift to a bear market.

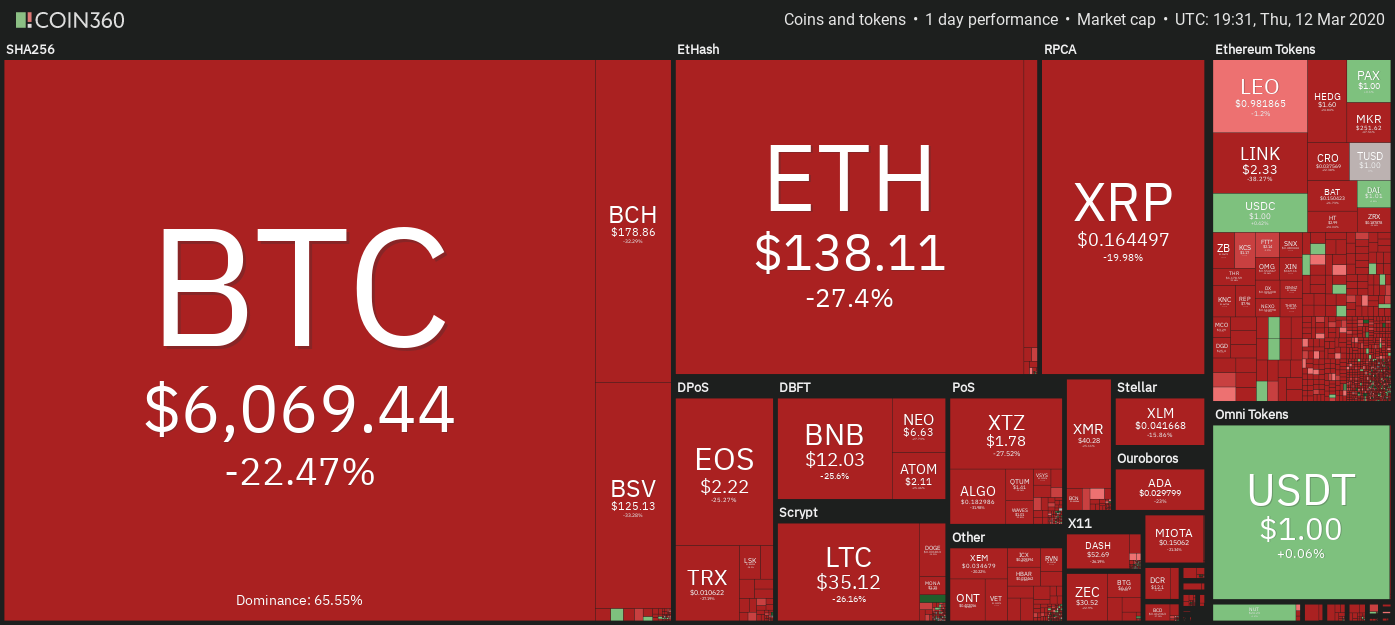

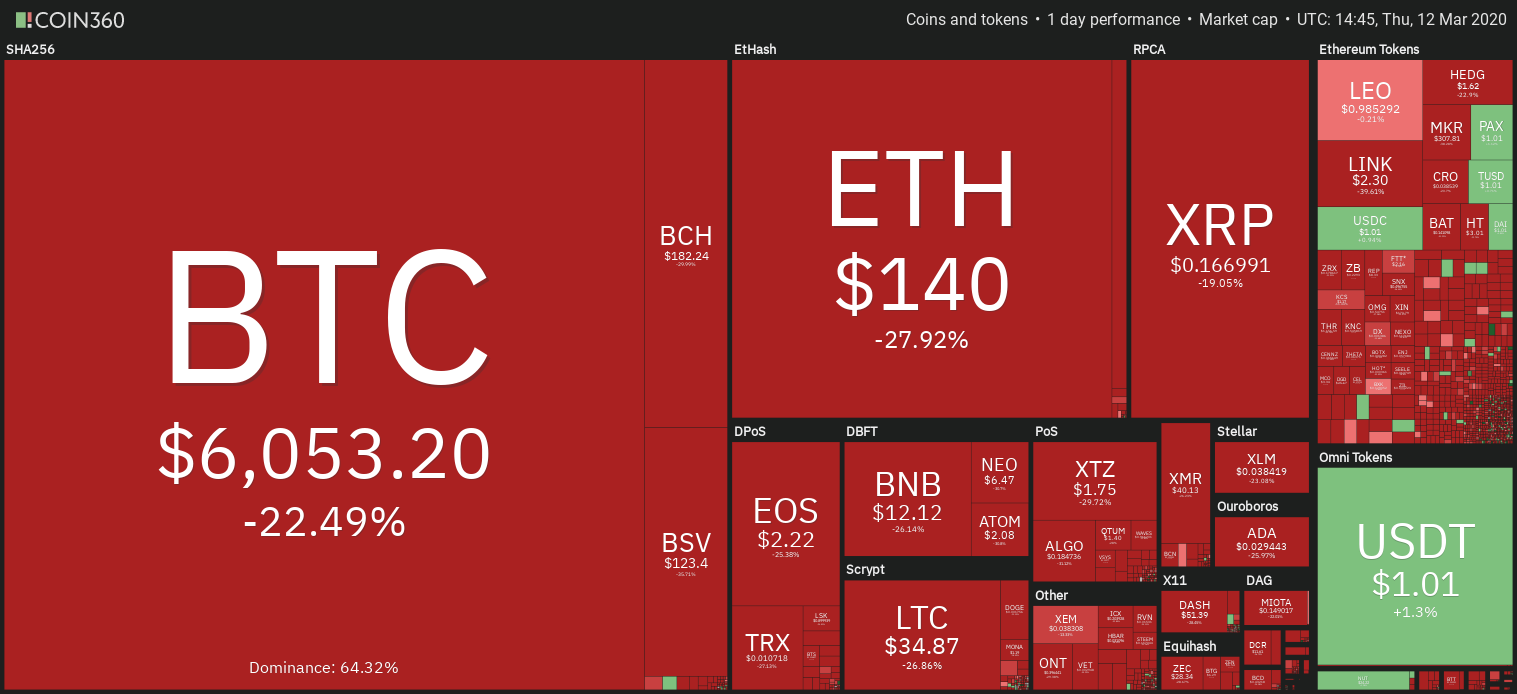

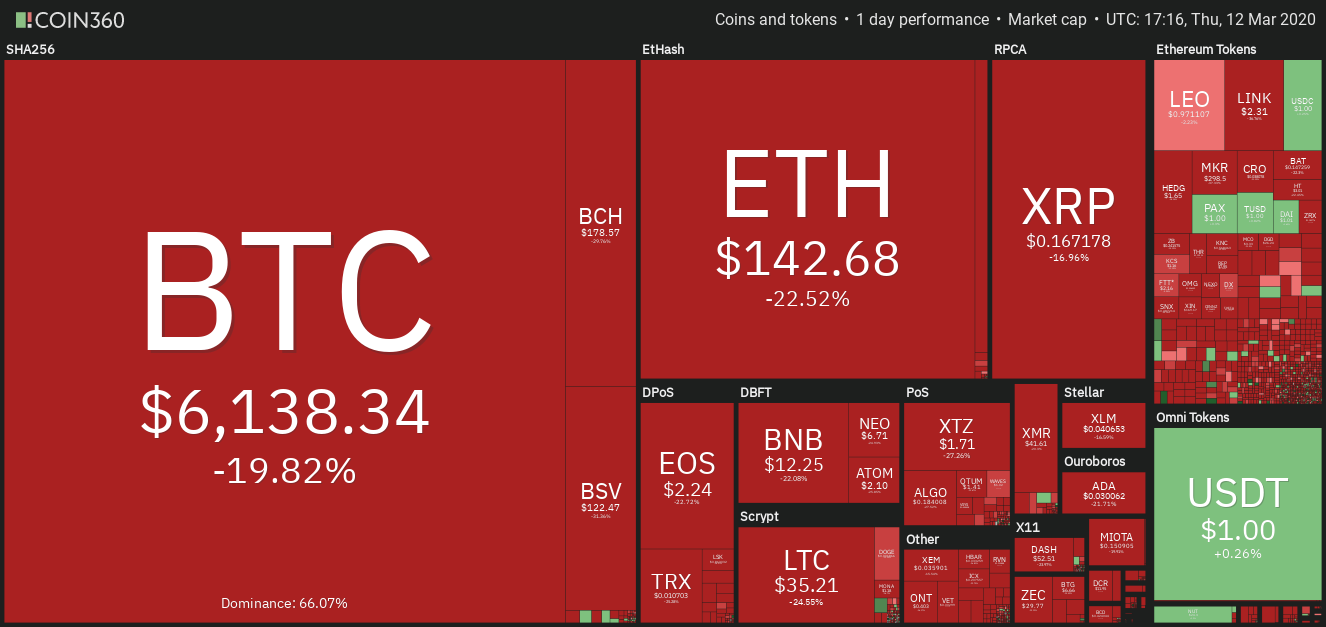

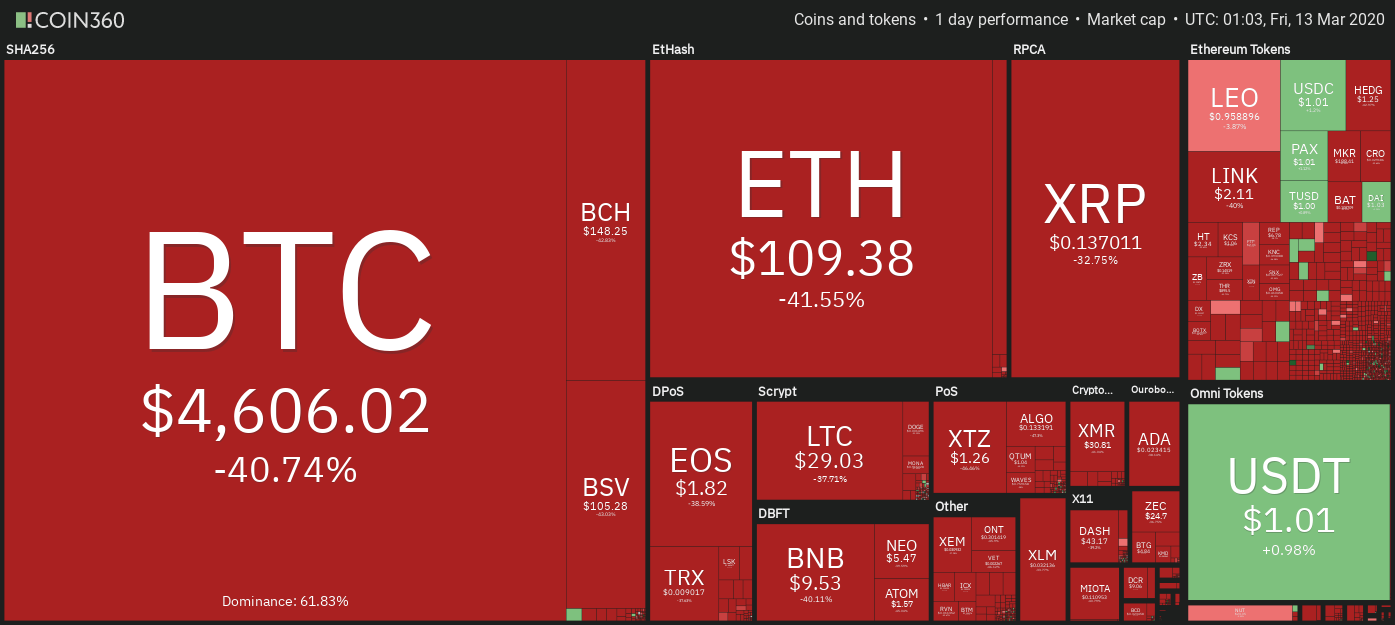

Crypto market daily price chart. Source: Coin360

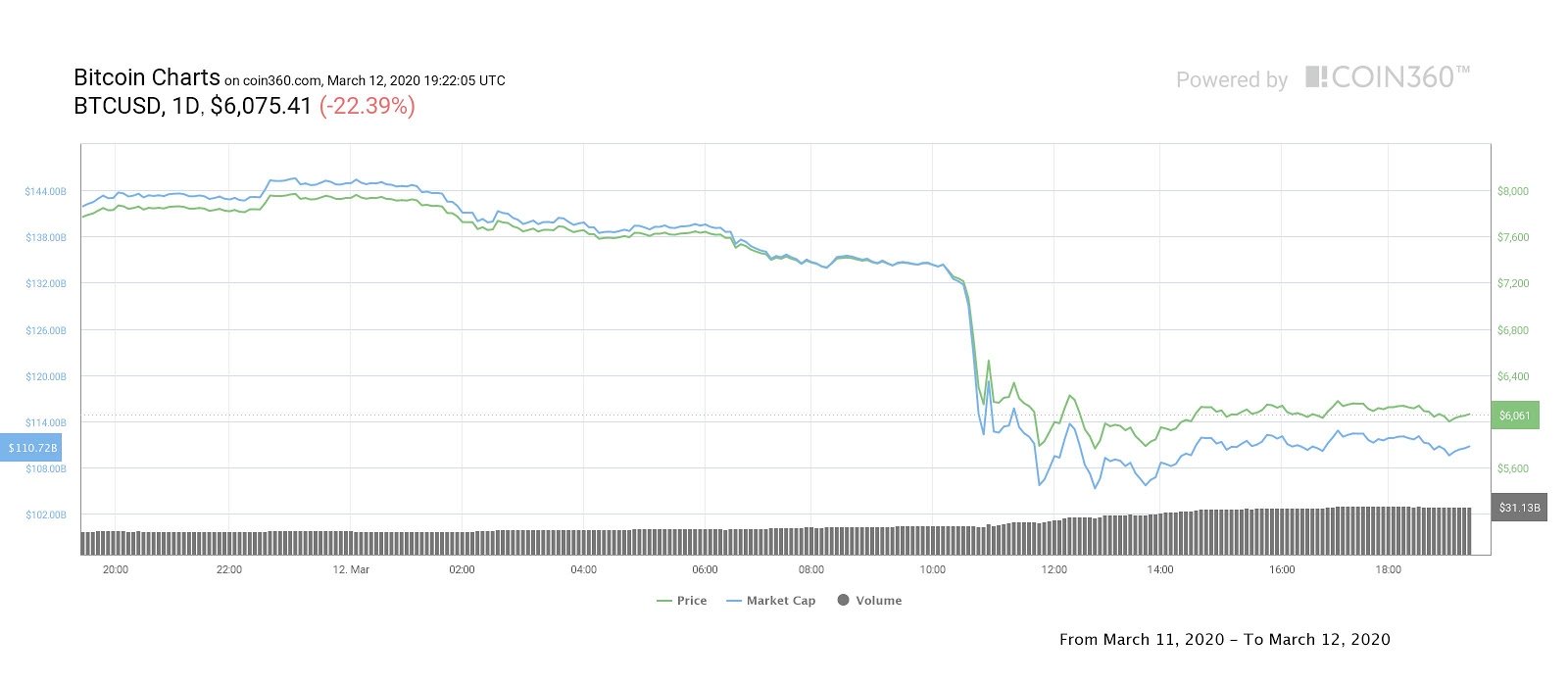

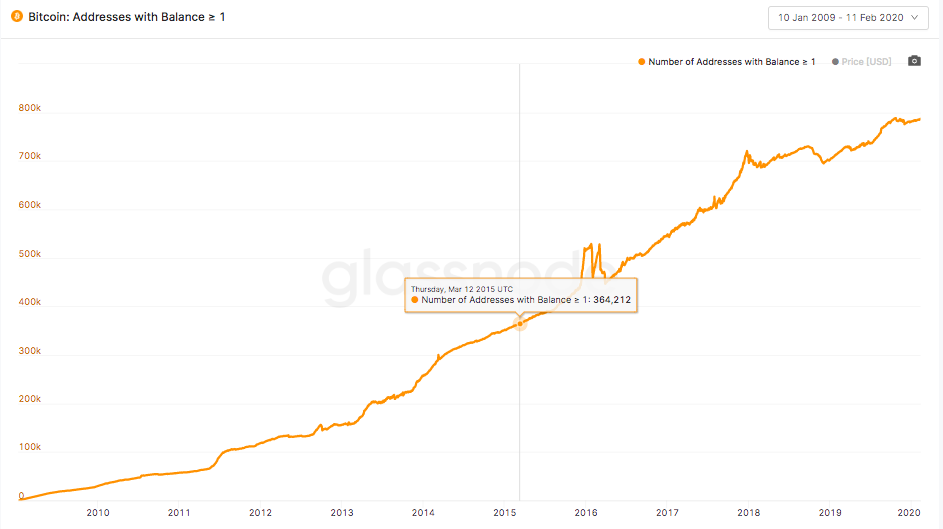

Meanwhile, Bitcoin’s (BTC) status as a store of reserve and volatility hedge was further tested today. The digital asset sharply dropped 28.35%, marking the largest single-day loss since December 2013.

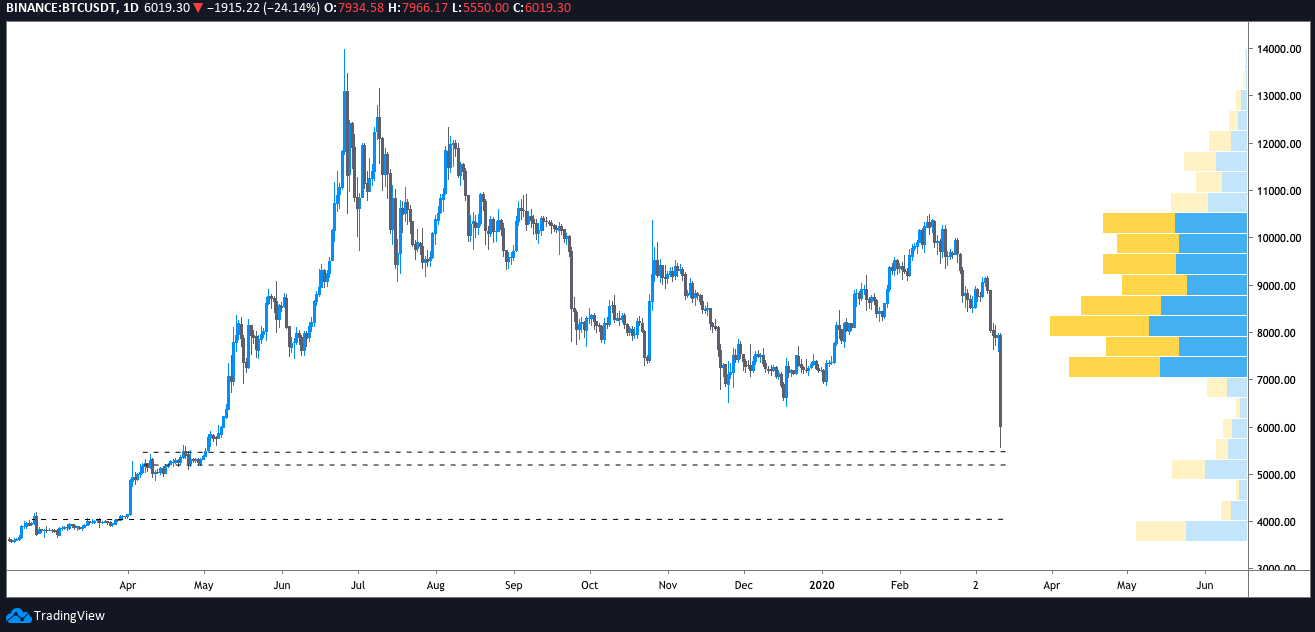

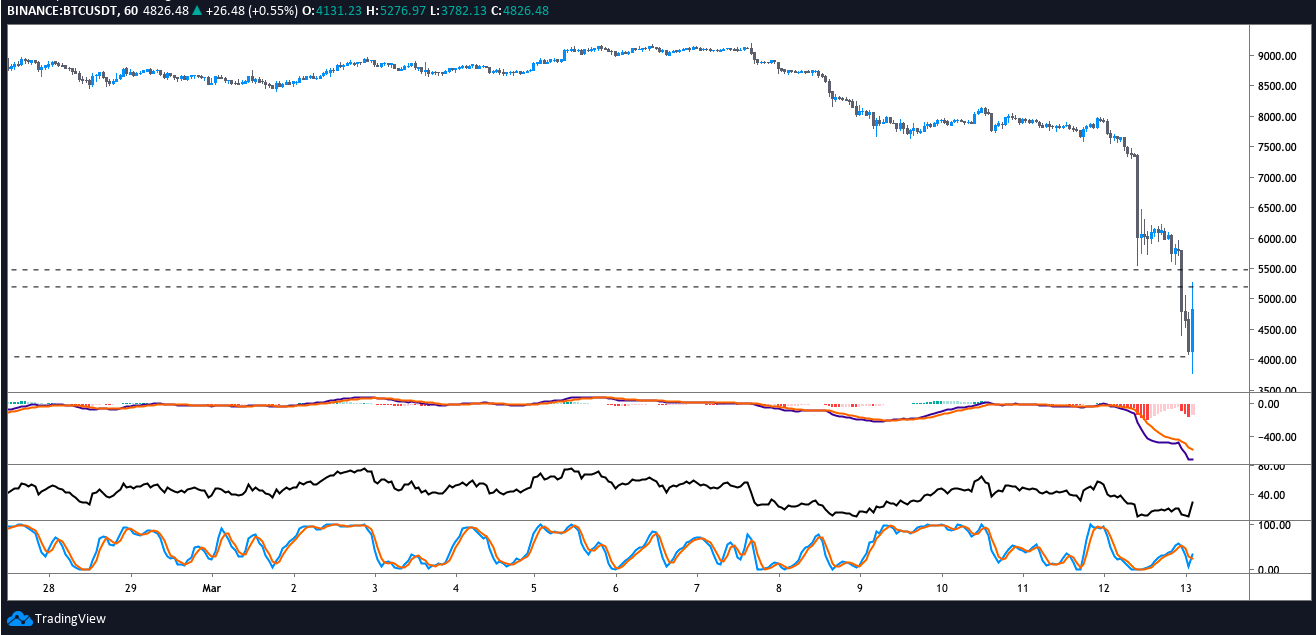

BTC USD daily chart. Source: TradingView

Today’s drop occurred on the highest volume spike seen since February 2018 and it pulled the price below key supports at $6,800 and $6,400 to a new 2020 low at $5,713. At the time of publishing Bitcoin price is struggling to hold $6,000, after reaching an hourly high at $6,229 on the news of the $500 billion Fed intervention. volume

What’s next for the price of Bitcoin?

BTC USDT daily chart. Source: TradingView

In a worst-case scenario, if the price is unable to hold $6,000, a revisit to $5,500 is likely and the volume profile visible range (VPVR) and Bitcoin’s price history from April 3 to April 30 show support in this range. Below $5,500 there appears to be support at $5,200 and below this level the VPVR shows purchasing interest at $4,050.

A positive sign would involve Bitcoin reclaiming the $6,400 and $6,800 support but at this point clearer signal of the equities markets finding a bottom is required before investors will show further interest in buying cryptocurrency, hence the declining buy volume on the hourly time frame.

Bitcoin daily price chart. Source: Coin360

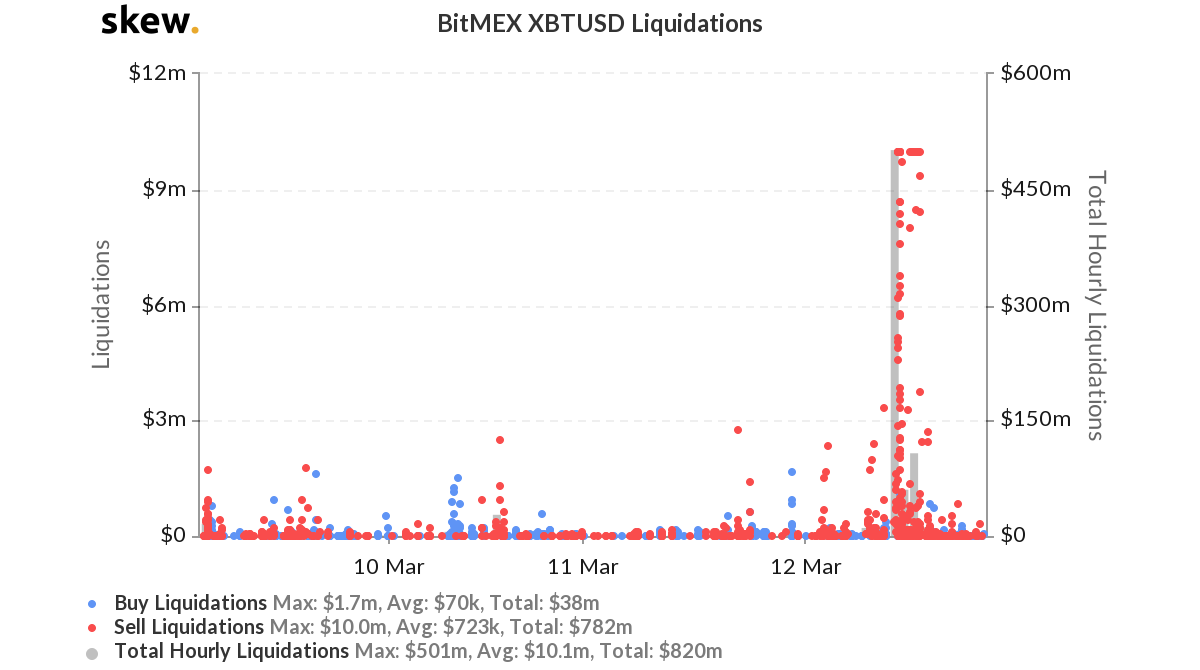

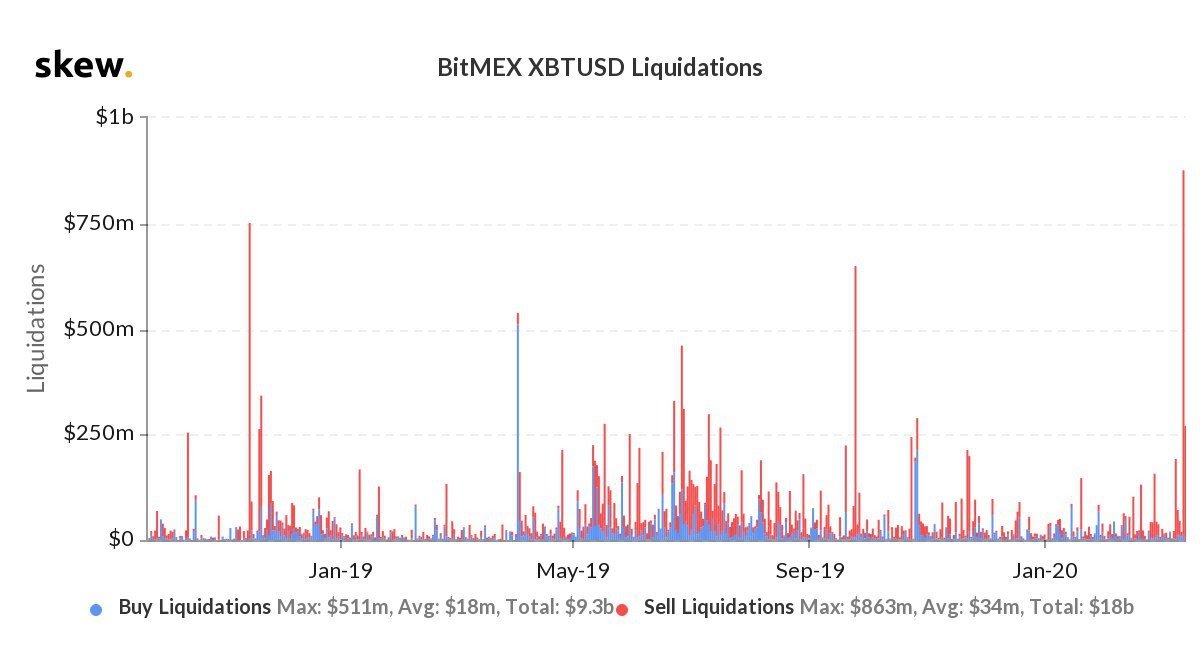

Altcoins were also slammed by today's strong pullback, with virtually every cryptocurrency in the top-50 dropping by double digits. In fact, today’s sell-off from $223 billion to $167 billion vaporized 25% of the cryptocurrency total market capitalization and data from Skew shows that $700 million in liquidations occurred on BitMEX.

BitMEX liquidations. Source: Skew

Notable losers from the top-ten were Ether (ETH) with a 27.14% loss, Bitcoin Cash (BCH) which dropped 30.77%, Bitcoin SV (BSV) lost 33.04% and Tezos (XTZ) dropped 27.09%. The overall cryptocurrency market cap now stands at $187 billion and Bitcoin’s dominance rate has risen to 65.3%.

加载中,请稍侯......

加载中,请稍侯......

Comments